4 – Paperwork, record keeping and digital reporting

Last Updated on 17 July 2025

Things to keep

If you’re paid PAYE it’s a good idea to hold on to the following bits of paper:

- pay slips

- P60 (each tax year if you’re employed on 5th April)

- P45 (on leaving employment, though not all freelancers get one)

- Bank statements

- Contracts and other agreements

Sole traders and people running companies need to keep hold of:

- Proof of purchase for business-related expenses

- Proof of turnover – i.e. invoices

- Bank statements

- Contracts and other agreements

- A record of income and expenses for the business

These are a minimum, and you should keep them for at least 6 years. This is in case you are audited by the tax office, or you have a query about tax.

What are business-related expenses?

Legitimate expenses (or ‘business costs’) can be recorded so that they are ‘offset’ against tax. This means they are deducted from your turnover at the end of each tax year, making your taxable profit smaller.

Every business is potentially different, so technically every business’s costs could be different. But there are parameters:

View outline of business expenses for self-employed people on gov.uk >

View self-assessment help sheets on gov.uk >

Sole Traders can also make use of special flat rates which are called simplified expenses. These include a sliding scale of flat rates for ‘use of home’ which covers heating and lighting the place in your home where you work.

The rates are not particularly generous, but they cut down on the paperwork. [Simplified expenses are not available to Limited Companies.]

View simplified expenses for sole traders >

We have set up an online calculator to help you work out sole trader ‘use of home’ expenses.

Sole Traders also have a Trading Allowance of £1000, which means you don’t have to report precise expenses figures on the tax return.

This can be beneficial if you have low expenses. But you still need to keep records so that you can tell if your actual expenses are more than £1000.

We have a spreadsheet for recording turnover and business expenses, with a guide to the expense categories and a tab for recording any costs in each category:

Download sole trader income and expense account spreadsheet >

Read a great overview of the Trading Allowance from the Low Income Group >

Can PAYE freelances get tax relief on costs?

HMRC is very suspicious of people who are paid as employed wanting to get tax back on expenses.

In their eyes it is the employer’s responsibility to reimburse their employees for out-of-pocket costs.

However there may be some scope to get tax relief in some categories of expense, as long as the employer is not reimbursing you.

You won’t be reimbursed for the whole expense – that’s not how tax relief works! But you might get a slightly lower tax bill, or a tax rebate at the end of the year.

To make things clearer, HMRC changed their systems slightly in December 2024, and you can read more about the process on this page:

Don’t get caught out (HMRC website) > (Opens in new tab)

Note that you need to have proof AND a justification for asking for the tax relief.

Everyone hates filing, so…

Set up a filing system that’s easy to top up as you go along, and easy to understand if you need to look something up later.

‘Making Tax Digital for Income Tax’ (MTD for IT) – a big change for sole traders and landlords

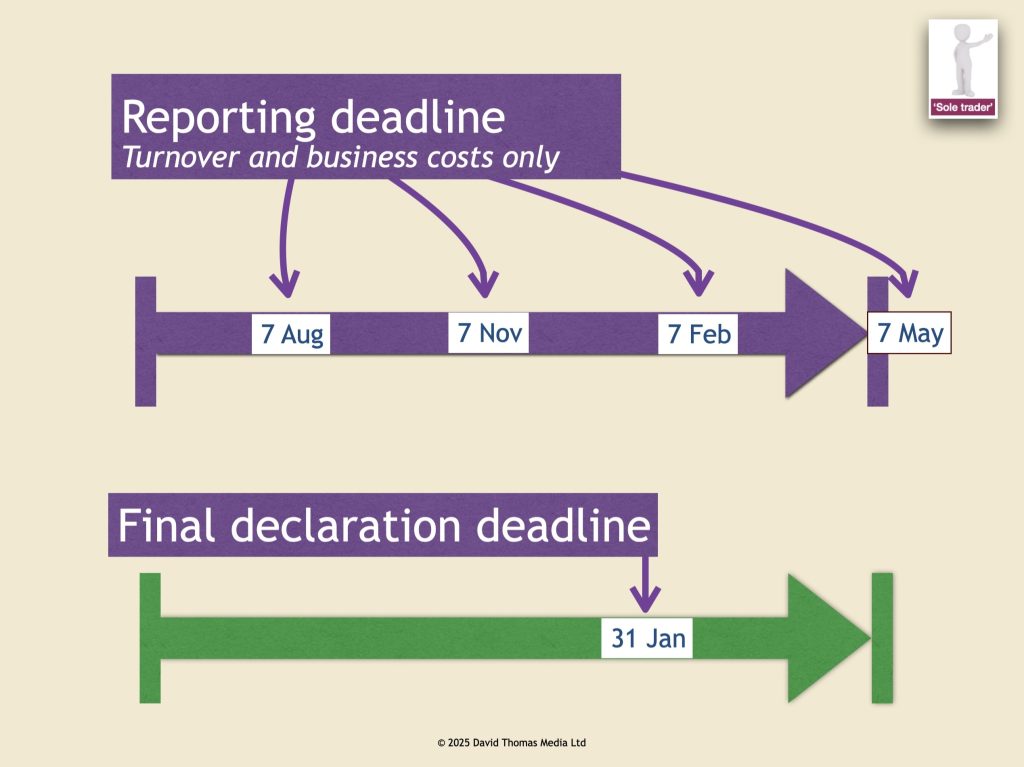

HMRC is introducing a new system of tax reporting. Eventually every business will have to:

- report income and business expenses every 3 months

- subscribe to special ‘cloud accounting’ software to do it

The date for reporting income tax in this way by some sole traders is April 2026 (delayed countless times for countless reasons).

HMRC has said you don’t have to use MTD from April 2026 if your sole trader turnover is less than £50,001 per year. From April 2027 the threshold will be £30,000 per year, drawing more sole traders into the MTD reporting system.

In the Spring Statement documents on 26 March 2025 the Treasury announced the threshold of qualifying income will drop to £20,000 per year from 6 April 2028.

Do you need to register for MTD for Income Tax?

What does HMRC mean by ‘an annual turnover of £50,000’? Well they’ve created an online tool which helps sole traders and landlords to work out if they have to become part of the MTD process.

The tool is quite simplistic on its own. So I recommend the first step is to look at what they mean by ‘qualifying income’.

Remember if you have a mix of PAYE and sole trader income, it’s ONLY the sole trader bit of your work that they are interested in here.

- Step 1: Do you have any ‘qualifying income’ for MTD for IT > (opens in a new tab)

- Step 2: Check if you need to register for MTD for IT > (opens in new tab)

There’s also a step by step guide from HMRC here > (opens in new tab)

Limited companies will have to report some information using special accounting software from April 2027, but at time of writing (July 2025) it won’t be quarterly. For limited company freelancers (so-called “micro entities”) it will just be profit and loss statement and balance sheet at the end of the year.

Meanwhile, any business with turnover above the VAT threshold (£90,000 in 2024- 25) has had to report VAT using the new system since April 2019. From April 2022 even the smallest VAT-registered business has had to use MTD software for their quarterly VAT returns. This means there are already loads of software options for MTD for VAT.

HMRC approves commercial software that works with Making Tax Digital for Income Tax. We’ve listed a few likely contenders below. Note/disclaimer: We have no idea if all the authorised software is any good. We haven’t tested them all!

MTD tip: If you’re looking at MTD software for the first time, consider what you might want to use it for in future. For example, some software does quarterly reporting but NOT the final declaration (tax return). Some does MTD for income tax but NOT MTD for VAT. If you are a sole trader who might want to be VAT registered in future you’d probably want to get software that does everything.

MTD software is going to be a moving target for a while. Expect tie-ups, special deals, mergers and even software companies going under, which is effectively what happened to Coconut Bank in 2023.

Recent examples of tie-ups are NatWest and FreeAgent, Tide and Sage.

Watch out for claims of ‘free’ or ‘freemium’ apps. This usually means that you have to pay for things like invoice creation within the software.

E.g. Xero has launched a cut down app aimed at sole traders and other very small businesses. Free to download (Apple only, initially), but you need to pay for more useful features.

Having said that, there may be some stand-alone apps that can be hooked up to your bank account regardless of who you bank with. Go Get Paid is an interesting example of this approach >

Forbes checked out some of the most commonly used software (Feb 2023). You can read their reviews here:

https://www.forbes.com/uk/advisor/business/software/best-accounting-software/

Find out more:

www.gov.uk/simplified-expenses-checker – Flat Rate expenses tool for car journeys and heating/lighting/use of home

www.gov.uk/…HRMC…/contact/self-assessment – Contacts for HMRC if you need guidance when filling in a tax return

www.gov.uk/…/self-assessment-helpsheets-main-self-assessment-tax-return

www.gov.uk/…-making-tax-digital – loads of MTD info

www.gov.uk/…/using-making-tax-digital-for-income-tax – how to use MTD for income tax

Commercial ‘cloud-accounting’ software:

www.freeagent.com – targeting itself mainly at small businesses and freelancers

www.xero.com – focussed on limited companies and sole traders www.quickbooks.co.uk – long established accounting software

www.sage.co.uk – well-established and used by large businesses too

HMRC list of MTD for Income Tax-compatible software:

www.gov.uk/guidance/software-for-sending-income-tax-updates

Disclaimer: We’re not saying any of these software providers are good or bad. Check them out at your own risk. If you have an accountant they should recommend the most appropriate.

We’re not pushing FreeAgent in particular, but it’s the one David Thomas Media uses. If you decide to go for it, you can get 10% off by clicking this button:

Income tax example – Sole Traders:

Before Making Tax Digital:

After Making Tax Digital:

Posted on 28 January 2020