1sp – Savings and Pensions

Last Updated on 8 July 2025

When starting out as a freelancer saving money is usually the last thing on your mind. You’re probably concentrating on how to earn more.

But taking a few minutes to think about savings can really help you feel in control of your finances. It can also avoid nasty surprises later on.

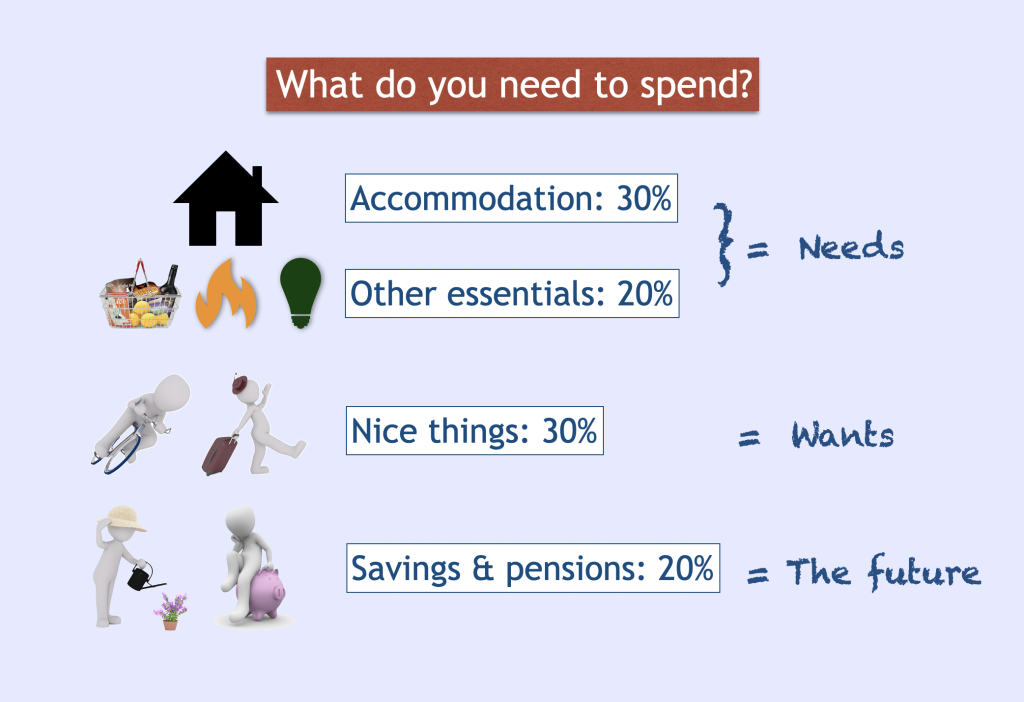

One general approach is to think about spending a certain percentage of what you earn in different areas of your life. For example:

This is just an example. It’s not universal and your personal circumstances will dictate what your own percentages need to be.

Types of savings

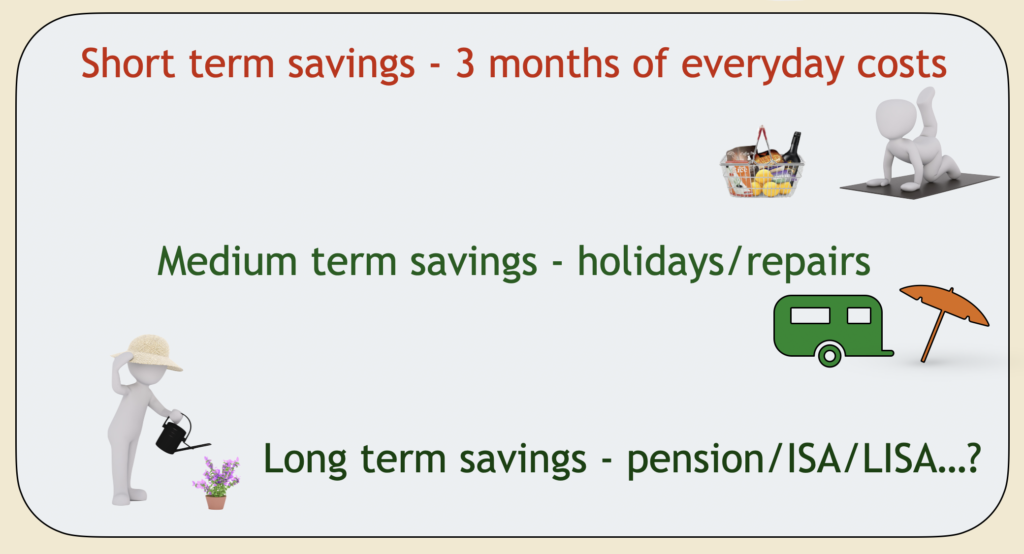

There are three types of savings to think about:

- Short term – putting aside about three months of living costs in case you have an income drought.

- Media term – having a pot or two for repairing your boiler, or going on holiday.

- Long term – having a plan for when you don’t want to work any more.

Short term

Work out how much you need to spend in a month to cover food, accommodation, hobbies and any other essentials.

Do this by keeping a spending diary or use one of the templates below.

You’ll end up with a typical monthly spending target. Multiply that by 3. That’s the target for your the minimum short term savings pot.

You now need to build up that pot. You can either take a percentage of your earnings, put a set amount aside every month, or do a mixture of both.

The important thing is to be able to get hold of this money quickly if you suddenly need it.

For example:

If your monthly living costs are £1000, your short term savings pot should be £1000 x3 = £3000.

If you put £100 aside every month you would have your pot in place within 2½ years.

Medium term

Set a target amount that would cover a holiday or replacing an ageing car or getting a new shower fitted. It’s up to you to decide what you’re saving for.

An alternative to putting aside a set amount is to put aside a percentage of your earnings, presuming that you’re saving for things that you only really have because you’re earning enough.

For example:

Imagine you earn £500 one month, £750 the next month, and £960 the following month. (This would be money you actually receive, so after tax.)

You could decide to put 10% aside from earnings for your medium term savings pot:

- Month 1: £50

- Month 2: £75

- Month 3: £96

If your holiday is going to cost £3000, you’re already nearly 10% there!

Long term

This is slightly trickier, as you have a number of options. The key thing is to build up a pot of money which will help you later in life, perhaps when you want to stop working altogether.

Pensions

There are three main types of pension which you should be aware of in the UK. They are not mutually exclusive. It’s perfectly possible to have all three. They are usually taxed as income when you receive them.

1/ State pension

This is a monthly amount the state gives you when you reach the state pensionable age. You can look up your state pensionable age on gov.uk. It will depend on the year you were born.

For example someone born in 1998 will get their state pension when they’re 68 years old.

To get the full basic state pension you have to have made National Insurance contributions for 35 years in your working life. You get a reduced pension if you have gaps in your NI record. You can fill gaps, but only going back up to 6 years. Get advice from the NI helpline.

The state pension is treated as taxable income. The current pension is about £11,973 per year (2025-26), which is probably not going to be enough to live on.

2/ Auto-enrolled workplace pension

This is the system which was introduced in 2012 to ensure that employees have a pension pot or their own. It applies to people who are paid through PAYE systems – in other words, people HMRC defines as ’employed’.

A minimum of 5% is taken from your earnings and put into a pension pot which is set up by the employer for all its employees.

A further minimum 3% of your earnings has to be put in from the employers own money as well. This makes the auto-enrolled pension system quite a good way of saving.

As the name implies, employees have to be automatically enrolled if they’ve been working at least 3 months on the payroll of the employer. But you can opt out of the system if you have other ways you’d prefer to save.

In fact some people are enrolled before that date, which means freelancers who are paid PAYE and move around a lot can often have multiple pension pots organised at different times by different employers.

Some employers make a point of NOT enrolling you in their schemes until a few months after your start. It saves them money.

BUT you can ask to be enrolled in their pension scheme from day one when you agree the work as a PAYE freelancer. Put this in your confirmation email if it’s what you want.

Being in a workplace pension scheme can be better than just putting the money in your own, as the employer has to put some of their own money in your pot.

At the moment each employer chooses the pension provider for all employees. In future it is likely that the system will allow employees to direct the employer to pay into a pension of their own choosing.

3/ Your own pension arrangement

You can set up a pension pot of your own and pay money in either regularly or when you can be bothered.

Pensions come in different forms, some being riskier investments than others. So it’s important to talk to someone who knows what they’re on about. You can find a pensions advisor via some of the links below.

The regulations have loosened up a bit in recent years. You can now do a number of things with a pension pot when you get to 55 years old (soon to be increased to 60 years).

For example:

1 – Buy an annuity: this is where you use your pot to buy a monthly income for the rest of your life.

The size of the monthly income will depend on the size of the pot, and how old you are when you buy the annuity. Clearly someone buying an annuity at the age of 60 is going to need more months of income than the same person buying an annuity at the age of 70.

2 – Take the pot as cash. Most of this will be taxed.

3 – A mixture of the two

You have to build up a sizeable pot across your working life to get a meaningful monthly income from an annuity.

Someone with a pot of £55,000 buying an annuity at 65 years of age would get less than £2,000 per year. If they waited until they were 70 they’d get roughly £1000 per year more, but that’s still less than £3,000.

This is why it’s important to get into the savings habit as early as you can.

As this type of saving is long term, it lends itself to using the ‘percentage of income’ system. Every time you earn try to get in the habit of putting (for example) 15% into long term savings.

Lots of pots

Having your money in multiple pension pots isn’t in itself a problem. You may be able to move pots together into one place.

New digital pension services are able to bring your pots together (eg Nutmeg or PensionBee), but check first that you won’t be charged unwanted fees for doing so.

Having multiple pension pots isn’t necessarily bad. But make sure you know where your money is! Keep all correspondence about pensions from any employer, and if you lose the details use the Pensions Tracing Service on gov.uk.

Update 17 July 2024. There’s a pension schemes bill in the King’s Speech which promises to improve the way multiple pots are handled, amongst other things. Yay!

Read my blog here >

Other ways of saving for the long term

Pensions aren’t the only way of saving for later in life.

Check out things like ISAs and LISAs as a way of savings without paying too much tax.

But don’t take my word for it! Talk to a financial advisor about your personal circumstances and personal aims.

Top tips

The important thing is to get into the habit of saving. Make it part of your normal way or managing your money, even if it’s just a fiver every month.

If you get a pay rise or increase your fee, put half of the increase aside into your savings pots every time you earn. Keep the other half of the increase to spend on whatever you like. You’ll feel better off and you’ll save more.

Templates to help you target how much to earn:

Monthly budgeting tool for freelancers >

Ideal earnings calculator >

Household spending record sheet >

Find out more:

www.moneysavingexpert.com – almost too much advice!

www.moneymagpie.com – tips on setting up a business, saving money, etc.

www.becleverwithyourcash.com – great tips, simply explained

Pension Tracing Service – Lost track of your pension pots? This government service may help.

Money Helper – government backed impartial advice – good for an overview too

How tax works with private pension contributions – gov.uk >

Professional financial advice:

www.unbiased.co.uk – find an advisor near you – for pensions, health care, savings, etc.

NB: David Thomas Media Ltd is not responsible for the content of other sites nor any financial advice provided by them.

Please note:

Although every effort has been made to provide accurate tips and information, David Thomas Media Ltd accepts no responsibility for any errors, omissions or out-of-date facts. Trainees are advised to seek up-to-date professional advice on all financial and tax matters before making decisions relating to these subjects. Nothing in our notes, courses, webinars, downloads or social media should be considered as financial advice.

We believe our tips are useful – but they are only tips!

Image credit: Peggy und Marco Lachmann-Anke from Pixabay

Posted on 30 January 2020