13 – Late payments – and how to avoid them

Last Updated on 5 September 2025

Wondering how to agree work in the first place? Check out help sheet 12 first:

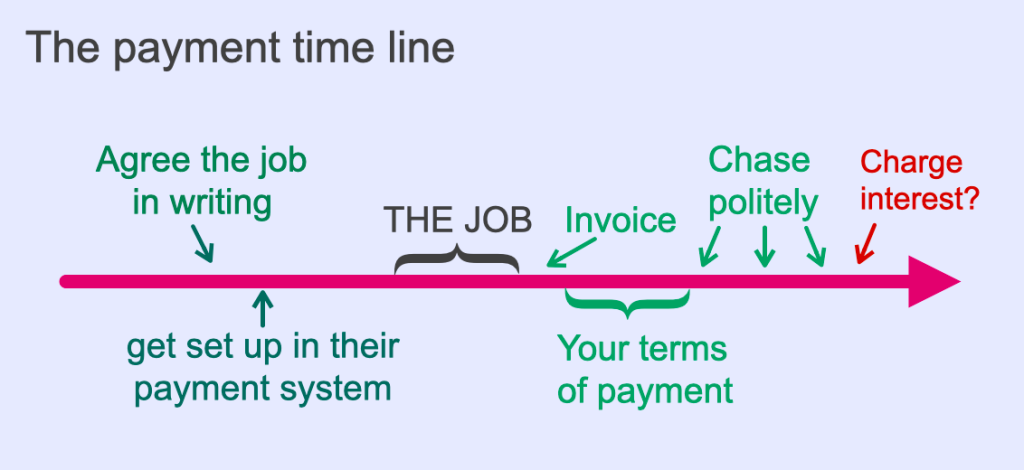

Once you’ve agreed a job (in writing) and done the work, you can look forward to getting paid for your time and skills.

Unfortunately there are a couple more stages to go through, especially if the payer is playing hard to get.

The golden rules are invoice early and chase every payment!

PAYE freelancing

If you’re a PAYE freelancer you should ideally be set up in the payment system of the organisation that has given you work before you start the job.

PAYE freelancers are usually paid on the day the organisation runs their payroll system. This is usually once a month and will vary from organisation to organisation.

Find out which date the payroll is run, and then check your bank account on that day. If the money hasn’t arrived just check with the person who runs the payroll – usually someone in HR.

Some organisations will have a slight delay between your finishing a job and the payment getting processed. For example, the BBC runs payroll on 15th of each month. It needs a job to be finished before 6th of a month to process it in the same month. Otherwise you will be waiting until 15th of the following month.

Sole Trader freelancing

Sole Traders (and limited company freelancers) will be invoicing for their work.

Here are the ways to make sure payments are not delayed:

- Send in the invoice as soon as possible after the work. If you leave it you might forget!

Your invoice should include date, terms of payment and a statement pointing out that you charge interest for late payments (see more about this below and on www.payontime.co.uk)

If you’re not sure what goes on an invoice, use my free invoice template >

- Make sure the invoice goes to the right person. This is often NOT the person who gave you the work. If you’re not sure of the routing of the invoice, ask your contact. Do not make assumptions.

- Chase the payment once the terms of payment have run out. Phone the person who actions the payment. This may be different from the person who gave you the work. Check they received the invoice and that you hadn’t made a mistake on it.

- If you get shirty or evasive answers after a couple more chasing phone calls, use the calculator on payontime.co.uk and send in an invoice for interest.

Update: On 31st July 2025 the government announced major changes to late payment legislation, including mandatory interest and maximum payment terms of 60 days in all cases.

Keep an eye on the Small Business Commissioner’s section of gov.uk >

Read more in my blog: An end to late payments for freelancers? >

Using the courts

Still having problems? All the UK’s nations have a court claim service which enables you to chase money that’s owed to you through the court system. (This is still sometimes referred to as the ‘small claims court’).

It’s designed to be quick and simple. Although there is a fee (depending on the amount you’re claiming) you might get this reimbursed if successful.

One trick with the court system is to fill in the form online and then save the draft. You can do this without submitting the claim.

You can then send the un-submitted claim form to the miscreant client saying you’re about to press submit.

That should frighten them into paying. They won’t want a court finding against them.

England and Wales:

https://www.gov.uk/make-court-claim-for-money

Scotland:

https://www.mygov.scot/court-claim-money

Northern Ireland:

https://www.nidirect.gov.uk/articles/recover-debts-owed-you

Don’t take it personally

Some people are nervous about chasing money they’re due for work they’ve done. My response is that it makes you look professional as long as you’re polite and matter of fact about it.

Chasing the money early on in the process with the accounts department will help you keep good relations with the person who actually gives you the work.

Also, if you chase early, you won’t be angry. You’re just ringing to check things are going through rather than to complain.

Ultimately, try to have a big enough pool of clients so that you don’t have to work again for the ones who don’t want to pay you.

Find out more:

Check out these sites that explain how to charge late payment interest and a compensation fee.

- www.smallbusinesscommissioner.gov.uk/interest-calculator

- www.payontime.co.uk

- www.gov.uk – charging interest and debt recovery >

- England and Wales:

https://www.gov.uk/make-court-claim-for-money - Scotland:

https://www.mygov.scot/court-claim-money - Northern Ireland:

https://www.nidirect.gov.uk/articles/recover-debts-owed-you

Image credit: Peggy und Marco Lachmann-Anke from Pixabay

Posted on 10 January 2020